A lot of people think that life insurance is only for those who are old enough to be retired. However, this could not be further from the truth. In fact, one of the best times to get life insurance is when you are young and just starting out in your career.

This type of insurance is known as universal life insurance.

A lot of people think that life insurance is something that is only for older people. But the truth is, life insurance is for everyone. And one type of life insurance that everyone should consider is universal life insurance.

Universal life insurance is a type of permanent life insurance. That means it covers you for your entire lifetime as long as you continue to pay the premiums. And unlike term life insurance, which only covers you for a specific period of time, universal life insurance has no expiration date.

One of the best things about universal life insurance is that it builds cash value over time. So not only does it provide protection for your loved ones in the event of your death, but it can also be used as a savings account that you can tap into when you need extra money.

Universal life insurance is a great option for anyone who wants lifelong protection and the ability to build cash value over time.

Table of Contents

Is Universal Life Insurance A Good Idea?

Universal Life Insurance Vs Whole Life

When it comes to life insurance, there are two main types of policies: whole life and universal life. Both have their own set of pros and cons, so it’s important to understand the difference between the two before making a decision.

Whole life insurance is the more traditional type of policy.

It offers a death benefit and cash value accumulation, but has higher premiums than universal life. The cash value grows at a guaranteed rate, making it a good choice for those who want predictability in their investments.

Universal life insurance is a newer type of policy that offers more flexibility than whole life.

Universal life premiums can be adjusted as needed, and the cash value can be invested in different ways to grow at a faster or slower pace. This makes it a good choice for those who want more control over their investment growth.

So which type of policy is right for you?

That depends on your individual needs and goals. If you’re looking for predictability and stability, whole life may be the better choice. If you’re willing to take on more risk for the potential of greater rewards, universal life could be a better fit.

Ultimately, it’s important to talk with an experienced agent to help you decide which type of policy is right for you.

Disadvantages of Universal Life Insurance

If you’re considering purchasing a universal life insurance policy, it’s important to be aware of the potential disadvantages. Universal life insurance policies can be more expensive than other types of life insurance, and they may not provide as much coverage. Additionally, if you don’t carefully manage your policy, it could lapse and you could lose all the money you’ve paid into it.

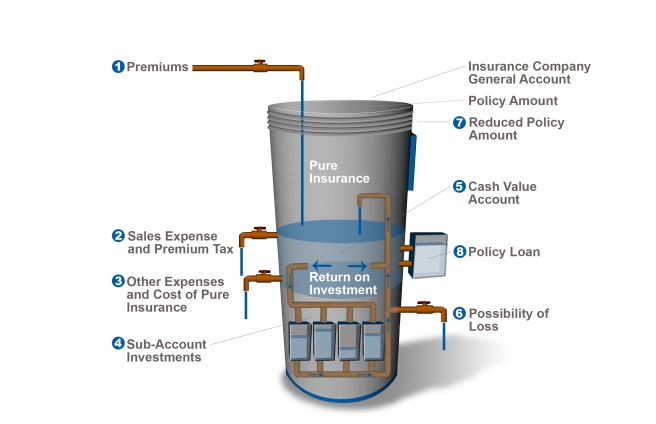

Universal life insurance policies are permanent life insurance policies that offer flexibility in how premiums are paid and how death benefits are used. The cash value component of a universal life policy grows tax-deferred, similar to a 401(k) or other retirement account, and can be accessed by the policyholder during their lifetime if need be through loans or withdrawals. Withdrawals and loans will reduce the death benefit available to beneficiaries upon the policyholder’s passing.

While a universal life policy offers many advantages over traditional whole life insurance – including lower costs, more flexibility on premium payments, and the ability to access cash value – there are also some potential disadvantages worth considering before buying such a policy. One downside to universal life is that it generally costs more than term life insurance. This is because with universal life, the insurer is taking on more risk since there’s no set time period for when payouts will occur (with term policies, payouts are guaranteed if death occurs within the specified term).

So while you may save money in premiums upfront with a universal policy compared to a whole life plan, over time those savings may be offset by higher costs. Another consideration is thatuniversal life policies typically provide less coverage than whole life plans – often only about 60-70% of the death benefit amount – so your beneficiaries may not receive as much money as they would with another type of policy. And finally, if you don’t keep up with premium payments or otherwise fail to properly manage your universal life policy, it could lapse; meaning all previous payments would be lost and your beneficiaries would receive nothing upon your death.

Problems With Universal Life Insurance

Life insurance is one of the most important financial products that you can purchase. It protects your loved ones in the event of your death and gives them the financial resources they need to maintain their standard of living. Universal life insurance is a type of permanent life insurance that offers flexibility and potential for cash value accumulation.

However, there are also some potential problems with universal life insurance that you should be aware of before purchasing a policy.

One problem with universal life insurance is that it can be complex. There are many moving parts to a universal life policy, including the death benefit, premium payments, cash value account, and investment options.

This complexity can make it difficult to understand how your policy works and what benefits it provides. It’s important to work with an experienced life insurance agent who can help you navigate the complexities of universal life insurance.

Another problem with universal life insurance is that it typically has high fees associated with it.

These fees can eat into the cash value of your policy and reduce the death benefit paid out to your beneficiaries. It’s important to carefully review any fees associated with a universal life policy before purchasing it.

Finally,universal life insurance policies are not guaranteed .

The cash value account within a universal life policy fluctuates based on market conditions and investment performance . This means that there’s a risk that the cash value could drop to zero , leaving you without coverage . While this is unlikely , it’s something to be aware of when considering auniversal lifepolicy .

Universal Life Insurance Pros And Cons

When it comes to life insurance, there are many different options available. Universal life insurance is one type of policy that you may come across. But what exactly is universal life insurance and how does it work?

Here’s a look at the pros and cons of this type of coverage to help you decide if it’s the right fit for you.

Pros of Universal Life Insurance

There are several advantages that come with universal life insurance.

One big benefit is that your policy can accumulate cash value over time. This cash value can be accessed for things like college tuition or other major expenses.

Another plus is that universal life insurance policies offer more flexibility than other types of coverage.

For example, you can typically adjust your death benefit and premium payments to meet your changing needs. This flexibility can be a lifesaver if your financial situation changes unexpectedly.

Cons of Universal Life Insurance

As with anything, there are also some downsides to consider with universal life insurance. One potential drawback is that these policies often come with higher premiums than other types of coverage. So, if you’re on a tight budget,universal life insurance may not be the best option for you.

Additionally, if you don’t pay close attention to your policy, it could lapse and leave you without any coverage at all.

Best Universal Life Insurance

If you’re looking for the best universal life insurance, you may be wondering what makes one policy better than another. There are several factors to consider when comparing policies, including the death benefit, premium payments, and cash value accumulation.

The death benefit is the most important feature of any life insurance policy.

It’s the money that will be paid out to your beneficiaries upon your death. The higher the death benefit, the more expensive the policy will be. However, it’s important to make sure that your beneficiaries will have enough money to cover funeral expenses and other debts.

Premium payments are another important factor to consider when shopping for a universal life insurance policy. Most policies require that you make monthly or annual premium payments. The amount you’ll pay each month will depend on your age, health, and coverage amount.

Some policies also offer flexible payment options, which can be helpful if you have a tight budget.

Finally, cash value accumulation is an important feature of universal life insurance policies. Cash value accumulates tax-deferred and can be used for things like supplemental retirement income or emergency funds.

Universal life insurance policies with good cash value accumulation can provide a lot of financial security in retirement.

Universal Life Insurance Example

When most people think of life insurance, they think of term life insurance. Universal life insurance is a type of permanent life insurance, meaning it covers you for your entire life as long as you continue to pay the premiums. Universal life insurance has several advantages over term life insurance, including the ability to build cash value and more flexible premium payments.

With universal life insurance, a portion of your premium goes into a cash account that earns interest. You can use this cash value to help pay premiums later in life or for other purposes if needed. The cash value can also act as a death benefit if you die before the policy expires.

Universal life insurance also offers more flexibility when it comes to premium payments. You can choose to pay more or less each month, depending on your budget and needs. This flexibility can be helpful if your income changes or you have unexpected expenses come up.

If you’re looking for permanent coverage that offers some additional benefits, universal life insurance may be right for you. Talk to your agent about whether universal life is a good option for you based on your specific needs and situation.

Is Universal Life Insurance Worth It

Universal life insurance is one of the more popular types of permanent life insurance. Universal life offers flexibility in premium payments and death benefits, and it can be a good choice for someone who wants coverage that will last their entire lifetime. But is universal life insurance worth it?

Here’s a look at the pros and cons of universal life insurance to help you decide if it’s the right type of policy for you.

Pros of Universal Life Insurance

1. Flexibility in Payments: With universal life insurance, you have the flexibility to make changes to your premium payments as your needs change.

If you have extra cash on hand, you can make larger premium payments to build up your cash value faster. And if you need to reduce your payments for any reason, you can do so as well (although this may impact your death benefit).

2. Builds Cash Value: Universal life insurance policies build up cash value over time, which can be accessed through policy loans or withdrawals.

This cash value can be used for anything – from supplemental retirement income to paying for major expenses like college tuition or a home renovation. And if you don’t need to access the cash value, it will continue to grow tax-deferred until you do need it.

3. Tax-Advantaged Savings: The cash value component of universal life insurance grows tax-deferred, which means you won’t pay taxes on the growth until you withdraw the money (at which point it will be taxed as ordinary income).

This makes universal life a great way to save for retirement or other long-term goals where tax-advantaged growth is desired.

Universal Life Insurance Quotes

When it comes to life insurance, there are many different options available. One type of policy that you may come across is universal life insurance. Universal life insurance is a type of permanent life insurance, meaning it will cover you for your entire life as long as you continue to pay the premiums.

Universal life insurance policies have two main components: the death benefit and the cash value account. The death benefit is the amount of money that your beneficiaries will receive if you die while the policy is in effect. The cash value account is like a savings account that accumulates interest over time.

You can use the money in this account for things like supplementing your retirement income or paying off debt.

Universal life insurance quotes can vary depending on a number of factors, including your age, health, and lifestyle. It’s important to compare quotes from multiple insurers before making a decision on which policy is right for you.

Credit: www.broadridgeadvisor.com

What is a Universal Life Policy in Insurance?

A universal life policy is a type of permanent life insurance that has both an investment component and a death benefit. The investment portion of the policy grows tax-deferred, and the death benefit is paid out to the beneficiary upon the policyholder’s death.

Universal life insurance policies are flexible, which means that the policyholder can adjust their premium payments and death benefit as their needs change over time.

This makes universal life one of the most popular types of permanent life insurance policies available.

While whole life insurance policies also have an investment component, universal life policies typically have lower fees and provide more flexibility than whole life policies.

What is the Benefit of Universal Life Insurance?

There are many benefits to having universal life insurance. One of the most important is that it can provide you with financial security in the event of your death. Universal life insurance can also be used as an investment tool, allowing you to grow your cash value over time.

Additionally, universal life insurance policies offer flexibility in terms of how much coverage you need and how often you make premium payments. This makes them ideal for people who want more control over their finances.

What is the Disadvantage of Universal Life Insurance?

There are a few disadvantages of universal life insurance to be aware of. First, this type of policy is more expensive than term life insurance. This is because it offers lifelong coverage and builds cash value over time.

Second, universal life insurance policies are complex, which can make them difficult to understand. This can make it hard to know how much coverage you really need, or what riders (add-ons) may be best for you.

Third, if you don’t pay close attention to your policy, the cash value could dwindle away and leave you with little death benefit coverage.

Make sure you work with a knowledgeable agent or financial advisor to help you choose the right policy and keep track of it over time.

Which is Better Whole Life Or Universal Life?

There are a few key factors to consider when deciding whether whole life or universal life is the better option. Universal life typically has lower premiums than whole life, but it also comes with more risk. Whole life policies have guaranteed cash value growth, while universal life policyholders can see their cash value fluctuate based on market conditions.

Another consideration is how you would like your death benefit paid out. With whole life, your beneficiaries will receive a lump sum payment upon your death. With universal life, you can choose to have your death benefit paid out over time, which can be beneficial if your loved ones need income replacement in the event of your passing.

Ultimately, the best type of policy for you depends on your specific needs and goals. If you are looking for a more affordable option with some flexibility, then universal life may be the way to go. If you want guaranteed cash value growth and a death benefit that pays out in a lump sum, then whole life could be the better choice.

Conclusion

Universal life insurance is a type of permanent life insurance that offers the policyholder flexibility in how their premium payments are invested. The cash value of the policy grows tax-deferred, and the death benefit is paid out to the beneficiary tax-free. Universal life policies also offer the option to take loans against the cash value of the policy, though this will reduce the death benefit.